The verdict is out – anyone who wants to run a successful and sustainable business should be focusing on retention. After all, it costs five times as much to attract a new customer than to keep an existing one, and increasing customer retention rates by 5% increases profits by 25% to 95%. Poor retention is a particular problem for enterprises in the health and fitness industry. In this article, we’ll discuss the practice of risk scoring. Risk scoring is the act of analyzing the potential loyalty of a customer or segment of customers, and is an essential component of an effective retention strategy. To address this challenge, operators can benefit from implementing fitness CRM software, which includes an advanced risk-scoring system.

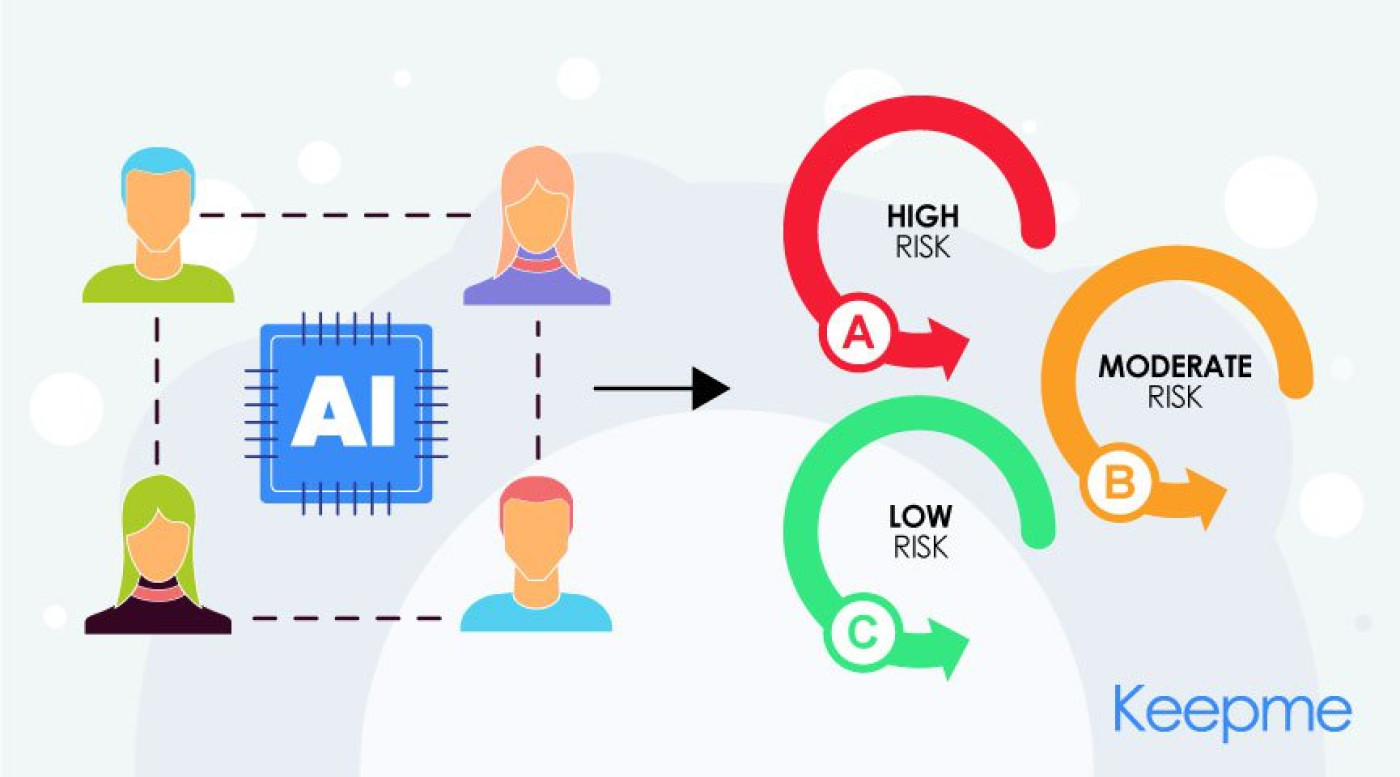

Some customers or customer segments are inherently more prone to churn than others. This is expressed in patterns of customer behavior, with some patterns indicating a higher probability to churn than others. However, without a risk scoring system, it is extremely difficult to identify these behaviors, and who high-risk customers might be. It is even harder to proactively take the necessary steps to prevent these ‘high-risk’ customers from leaving. An effective risk scoring system will not only identify who high-risk customers are but will also be able to do it in a timely fashion for you to make the necessary changes before it is too late.

About risk scoring

The practice of risk scoring assesses the probability (or risk) that a given customer or segment of customers will churn, ceasing to do business with you. There are a variety of factors that come into play in determining the risk of a particular customer or segment of customers churning. While the specifics will vary between contexts, some factors that are likely to be important include how often they attend the gym, their purchase history, and how long they have been a member of the gym.

Risk scores can also be aggregated. Aggregating risk scores is particularly helpful for individuals who run several clubs or facilities at the same time. By comparing clubs’ overall risk scores, it is easy to tell at a glance which clubs are doing better than others at retaining their members and to swiftly respond to that information.

In addition, most risk scoring systems will also be able to segment your customer base based on their risk scores and provide you with a visualization of the composition of your demographic relative to these segments. Here’s an example of two personas that you may see in your gym:

‘John’ refers to a customer with a low risk of churning. He’s been a member of the gym for a few years, regularly attends the gym, and has even brought some new clients to the gym through referrals.

‘Jane’ refers to a customer with a high risk of churning. She signed up for the gym a few months ago but does not attend the gym regularly. In addition, she is coming close to the end of her fixed membership period.

With insights into the profile of your customers, you will be able to develop marketing and communications strategies that effectively meet your demographic.

Risk scoring in retention management

One of the best ways to utilize risk scoring in retention management strategy is through the practice of micro-segmentation marketing and communication. Micro-segmentation refers to the practice where customers are divided into niche personas or ‘segments’ based on several specific characteristics such as demographic information or behavioral attributes.

Micro-segmentation marketing, in turn, refers to a marketing strategy that creates “hyper-focused campaigns” to accurately satisfy the needs of each of these varying types of customers. This strategy is incredibly effective because one of the best ways to retain high-risk customers is to meaningfully engage them and help them to understand the value of what your business offers. Remember ‘John’ and ‘Jane’? Here’s an example of how two different types of strategic communication could be developed based on their risk scores:

Since ‘John’ has a low risk of churning, we do not need to spend too many resources on ensuring that we keep his business. He is very likely to be retained even if no action is taken.

Since ‘Jane’ has a high risk of churning, more resources should be spent on attempting to retain her as a customer. Jane should be sent a special offer to encourage her to stay on with the business, and customer service officers ought to meaningfully engage Jane to better understand her needs.

Technology and risk scoring

In this article, we’ve discussed two simplified examples of how risk scoring can work to improve your membership retention rate. However, in reality, the various personas you find in a given facility are bound to be more numerous, and the precise communications strategy required more nuanced and sophisticated. Indeed, risk scoring is a very complicated, and potentially tedious process for human hands. The work necessary to carry out accurate and effective risk scoring as a part of retention strategy is exorbitant, and unfeasible for most businesses.

Fortunately, predictive analytics, big data, and other sophisticated technologies have been shown to be effective at risk scoring in some industries. Should a business in the health and fitness industry implement a fitness-specific risk-scoring technology, they are bound to see its retention rates quickly improve.

Conclusion

It is crucial to understand how effectively you are (or are not) retaining your client base. In their 2018 NPS and CX Benchmarks Report, CustomerGauge discovered that “a shockingly high” number of companies can’t report how many customers they are losing annually, with 44% of respondents and 32% of senior management not knowing their retention rate. This is unacceptable. Tracking and managing member activity is a vital component of managing a business and sustaining membership retention in the health and fitness industry. Risk scoring, which we’ve discussed today, is an important part of getting to grips with your member demographics and, accordingly, improving your business’ membership retention.

Discover Keepme in your custom demo

Book your FREE 15-minute demo and discover how Keepme can revolutionize your sales and membership processes.

---3.png)